With the Consumer Data Right (CDR) introduction in Australia in mid-2020, the focus on open competition has shifted how we think about user experience in data-driven products and services. As a result, designing with the CDR in mind has become a critical aspect of creating a seamless and trustworthy experience for consumers.

The goal of CDR has always been to empower consumers with control over their data. Let’s be clear. Secure sharing of data has the potential to transform industry landscapes. It’s pretty much already happening.

With the introduction of CDR last year, open banking has made its way into the banking reality. Big banks and small start ups are integrating it into their services. More data holders are about to enter the ecosystem. It’s building in momentum. Which means now is a good time to ask: what actually is open banking?

It's an infrastructure allowing customers to take their banking data and securely share it with an accredited party. Open banking is also a framework to help financial service providers align to the outcomes that matter to their customers. That's using customer data to offer better products and services.

Open banking is the Consumer Data Right in action.

Yes, it’s slow action, but we’re making progress. We’re at a point where consumers can actually use open banking for their own benefit. It should help consumers achieve financial wellbeing. But the truth is, consumers haven’t played the central role in the development of open banking that they should have. This is because of the way CDR evolved.

Don't get me wrong, CDR is a huge deal. It's great. So is open banking

But it has been initiated by policy discussions and bureaucrats. It was driven by technical standards. It has evolved haphazardly with organisational stakeholders and their agendas shaping the ecosystem.

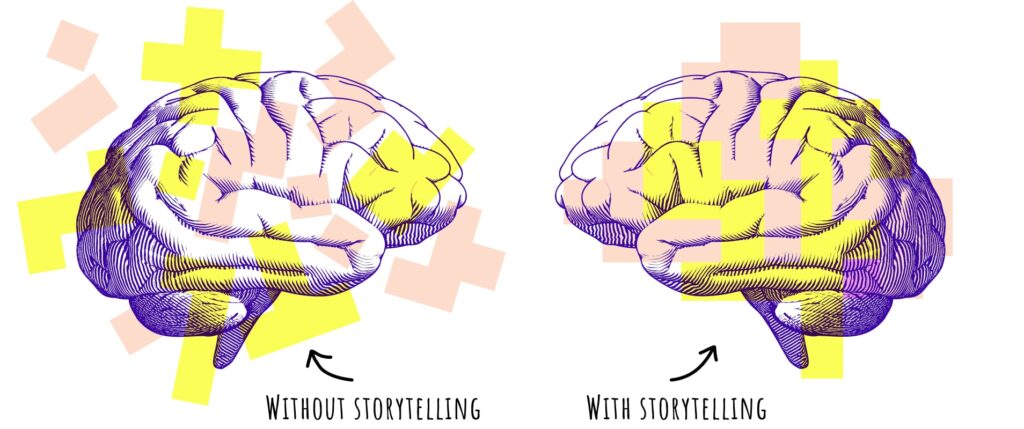

This is not to dismiss the technical, business and regulatory complexity. This is complicated stuff. Legacy infrastructure, standardised ways for authentication, designing for meaningful consent. Loads of commercial agendas to navigate. Unfortunately, the Australian consumers got lost along the way. CDR is compelling for Australian consumers, they’ve just been cast as an extra rather than the main protagonist of the story. And the point is, storytelling is important. Let me explain.

Storytelling is a holistic approach to experience design.

Now when people hear design, they think of pretty pictures and the colour palette of a website. It's a cliche I know but it's all too common. Let's narrow it down further and define the term like this: Design simplifies the complex. Experience design focuses on the customer experience. The touchpoints and interactions that make it easier for people to get to the outcomes they care about. It puts the customer first by staying relevant to their needs and what matters to them. It makes them the main protagonist.

Storytelling in experience design represents the narrative of the customer experience.

It helps order the chaos and evokes emotions. If design is the heart of an experience, storytelling is the soul. It’s the best way to relate to the human behind the screen.

An open banking breakthrough needs the customer at heart. We need to explain why open banking experiences make people’s financial lives better. More convenient, more cost effective, with better outcomes. We need to be relevant, human-centric and deliver an emotional benefit. Because information alone is not emotional. Storytelling can change that.

CDR has been about the banks and the organisations that are in it with less focus on the consumer. It’s a fact that most consumers don’t even understand what open banking or CDR is. Let's shift the focus back to the consumer. Let's design open banking experiences that make consumer lives part of it. Their fears, hopes and dreams. With their needs at the core of the product experience.

I wanna give your three examples. Three use cases that show the relevance of storytelling

1. Home loan applications

First I wanna take a look at home loan applications. Think of a first home buyer couple, newly weds (expensive First I wanna take a look at home loan applications. Think of a first home buyer couple. Newly weds with a baby on the way, trying to put an offer in for a place they’ll call home for the next thirty years. That’s an incredible financial commitment in a period that’s likely the most stressful in life. Applying for a home loan can be a daunting experience. Collecting all the necessary documents is exhausting and time consuming at best. It means sourcing, requesting, receiving, printing, scanning and sending banking data. Data that banks could share within a few minutes. Secure, fast and convenient.

Designing a home loan application experience means understanding the people behind the application. A narrative can relate to the customer while educating on the benefits of CDR and open banking. It’s here to make their lives easier! Remember, CDR is still a new concept and most consumers don’t even know what it is.

2.Switching banking providers

The next thing I want to look at is switching banking providers. Let's say I've just landed my first job after uni. I've been banking with CBA since I was a kid, part of the Dollarmites club. I’ve grown up since then, developed certain values and want to switch to a bank that aligns with them. A bank that gets me. One that will help me invest for my future and the future of the planet I care about. But that requires hours and hours of searching and reading. What if I could just state some value based preferences and share my banking and account info? See the offers and make a choice on who to go with. Storytelling means harnessing these consumer stories and turning them into experiences. Designed to simplify the complex. Designed to problem-solve.

3.Personal financial management

Lastly, I wanna touch on one of the most important topics of our time: personal finance management. It’s very big. It’s very complex. We're all walking the winding paths of life. We know how unforeseen events can change it from one moment to the next. The spending data we collect along the way gives huge insight into people's behaviour. Financial providers could now respond with tools that create financial wellbeing. Helping people save for what matters, spend where they can afford to and save for a rainy day. That's giving people control over their data and their finances. Leading to existential security. Something we all strive for. Yet, something so hard to achieve in a world of blinding consumerism and foul advertising promises.

Experience design and storytelling can connect with consumers and educate. Helping people see and experience the power of their data. It could even put a stop to a rising debt vs GDP ratio, contributing to a more sustainable financial ecosystem.

Long story short. A story-led experience can help people understand the value of open banking and CDR enabled products. How they can improve their lives. It’s a chance to close knowledge gaps and educate. Putting the customer and their story centre stage. It’s a way to connect and relate. It translates cold and abstract data into something emotional with purpose. It creates relevancy and meaning.

If you want to know more about how experience design and storytelling can help your open banking or open data project, let’s chat.

the muteo team